Step into the realm of fintech in 2024, where we sift through the buzzwords and jargon to decode what the upcoming year might bring. This article delves into the prevailing fintech trends that are molding the industry, examining the intricacies of embedded finance, AI advancements, sustainability initiatives, the ascent of Neobanks, and the transformation of global transfers.

Embedded Finance

So, what's the deal with these fintech trends? Embedded Finance is like that friend who seamlessly blends into any group, making friends wherever they go. Except, in this case, it's financial services snuggling up with your everyday experiences. Think of it as finance going undercover, incognito style.

Embedded finance is all about weaving financial services seamlessly into everyday non-financial experiences. Picture a coffee shop app making payments as easy as a single click or an e-commerce store offering insurance right there in the shopping cart – that's the essence of embedded finance in action. It's like turning your regular interactions into financial power moves without missing a beat.

The impressive growth of embedded finance

Experts anticipate a substantial expansion in the global embedded finance market, projecting a surge from US$264 billion in 2021 to a staggering US$606 billion by 2025.

As an illustration, Lyft, the ride-sharing app, provides its drivers with a dedicated checking account and a linked debit card. This unique account allows drivers to receive instant payments right after each ride, eliminating the need to wait for consolidated payments weeks later. Additionally, drivers can utilise their Lyft debit card to access and spend their earnings while enjoying exclusive cashback and rewards not available through any other means.

Skynet AI

Yep, I know, you can’t escape the onslaught of people prophesying about how AI will save the world / end the world / make your job easier / take your job, but here is how it could improve the world of Fintech.

One significant area where AI provides immense value is in risk management and fraud detection. Machine learning algorithms analyse vast datasets in real-time to identify patterns indicative of fraudulent activities. This not only enhances security measures but also allows fintechs to proactively address potential threats, safeguarding both businesses and users. Moreover, AI-driven risk assessment models enable more accurate predictions, helping fintech companies make informed decisions when extending credit, managing investments, and navigating complex financial landscapes.

Another crucial aspect is the enhancement of customer experiences through personalised financial services. AI algorithms analyse user data, transaction history, and behaviours to offer tailored financial recommendations and product suggestions. This level of personalization not only fosters customer loyalty but also assists users in making more informed financial decisions. AI-powered chatbots and virtual assistants further contribute to a seamless customer service experience by providing instant and personalised responses to user inquiries, resolving issues efficiently, and improving overall user satisfaction.

Automating time-consuming tasks

Additionally, AI plays a pivotal role in automating back-office operations, streamlining processes, and improving overall operational efficiency for fintech companies. By automating routine and time-consuming tasks such as data entry, reconciliation, and compliance checks, AI allows human resources to focus on more strategic and value-added activities. This not only reduces operational costs but also minimises the likelihood of errors, ensuring the accuracy and integrity of financial data. In essence, AI is a transformative force that empowers fintechs to operate more efficiently, make data-driven decisions, and deliver innovative and personalised financial services to their users.

For example, Enova employs AI and machine learning in its lending platform for advanced financial analytics and credit assessment. Targeting non-prime consumers and small businesses, the company aims to address real-life challenges like emergency expenses and bank loans without creating undue strain for the lender or recipient.

Sustainability fintech trends

Sustainability has become somewhat of a meaningless buzzword of late with the fintech industry getting in on this whole sustainable living vibe thing. However, the European Commission, playing the role of the sustainability sheriff, is making banks and insurance companies spill the beans on their eco-friendliness with the Corporate Sustainability Reporting directive. This will hopefully force companies to go beyond superficial greenwashing and virtue signalling. It's like a financial reality show, but instead of drama, it's all about being green and clean.

Leading the charge, some fintechs and banks are already committed to sustainability. Several Neobanks and payment providers are prioritising Environmental, Social, and Governance (ESG) disclosure, creating environmentally conscious financial products and services. For example Triodos Bank publishes details of every organisation they lend to.

Additionally, fintech and banks are minimising their own environmental impact, with some pledging to become carbon neutral and reduce waste. Aspiration’s goal is to help large enterprises, businesses, and individuals address unavoidable emissions and achieve their climate goals. Their team of climate experts deploys advanced monitoring and reporting tools to ensure every project delivers dependable and permanent impact, strengthens biodiversity, and benefits local communities.These initiatives are expected to influence customer decisions, as a growing awareness of sustainability encourages individuals to choose financial institutions dedicated to social and environmental responsibility. Hopefully these fintech trends will be more than superfical greenwashing.

Neobanks exploiting growing niches

The meteoric rise of Neobanks represents a paradigm shift in the banking landscape, fueled by a digital-first approach that caters to the evolving preferences of modern consumers. Neobanks, unburdened by the legacy infrastructure of traditional banks, have swiftly capitalised on the growing demand for seamless, tech-driven financial services. These agile entities leverage cutting-edge technology to offer user-friendly interfaces, swift onboarding processes, and transparent fee structures, resonating particularly well with the digitally native demographic. The growth trajectory of Neobanks is indicative of a broader trend where customers increasingly prioritise convenience, accessibility, and a personalised banking experience.

One of the key strengths of Neobanks lies in their adeptness at exploiting niches within the financial market. Rather than adopting a one-size-fits-all approach, Neobanks often target specific segments or demographics that may be underserved by traditional banking institutions. Whether it's catering to freelancers, gig economy workers, or international travellers, Neobanks identify and address niche needs with specialised financial products and features. This targeted approach not only fosters customer loyalty but also allows Neobanks to carve out distinctive market positions in a crowded industry. As Neobanks continue to refine their strategies and expand their offerings, their ability to exploit niches will likely remain a driving force behind their sustained growth.

For example Hyperjar helps you keep track of your money by dividing your budget between what they call Jars. They are basically digital piggy banks that make it easier for you to visualise where your money is going.

Instant Global Transfers with Comprehensive Tracking

A global shift towards instant payment systems is underway, with an increasing number of national payment schemes adopting this swift and efficient approach. Notably, some of these systems are transcending borders, providing the groundwork for international instant cross-border payments. This significant trend is poised to reduce costs and enhance the overall efficiency of the global financial system. The growing participation of banks in instant payment networks promises both consumers and businesses a more streamlined and effective payment experience. The global expansion of SWIFT GPI is emblematic of this evolution. Operating akin to tracking systems for packages, end users now have the capability to trace cross-border payments seamlessly on a global scale, introducing heightened transparency and efficiency to the financial system.

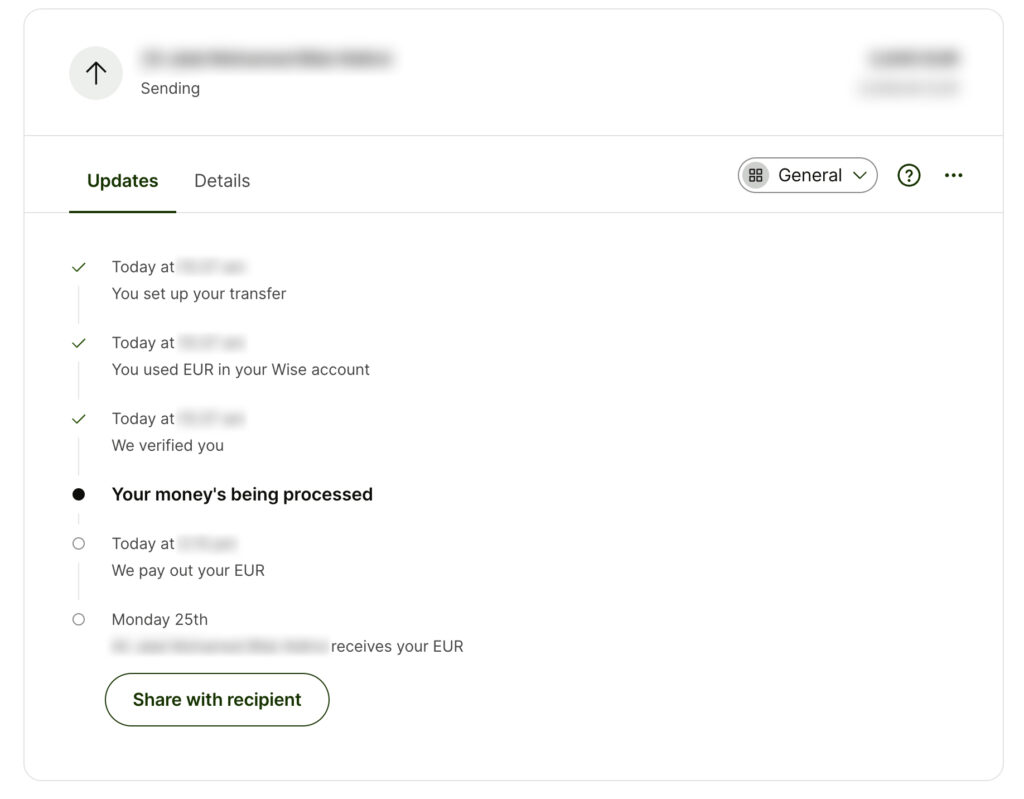

Wise significantly simplifies global transfers, providing tracking methods that alleviate the stress of sending your hard-earned money to a foreign country, especially when you may be unfamiliar with their banking system.

While certain fintech trends in 2024 will catch us by surprise, others, like the inevitable surge in mobile payments, are as clear as day. Predicting the future is a bit like predicting the weather – you might get close, but there's always an element of uncertainty. That's where having an agile design partner comes in handy. Meet Bridge Studio, your go-to boutique UX and brand agency. We trim the fat of bureaucratic behemoths, seamlessly blending into your organisation to provide top-notch user experience and design support. Let's chat about how we can give you that competitive edge you've been craving!

No comments.