It’s old news, the traditional banking sector is outdated and getting crushed by a surge of fintechs providing customers with a wider and personalised product offering. The current pandemic fuelled bank digitalisation and investment in the fintech sector, creating a pathway for more B2B and B2C fintech brands and a new breeding ground for unicorns. In the last 2 years, the number of fintechs worldwide has tripled from over 12,000 in 2019 to 26,000 in 2021.

Oversaturation of Fintech Brands

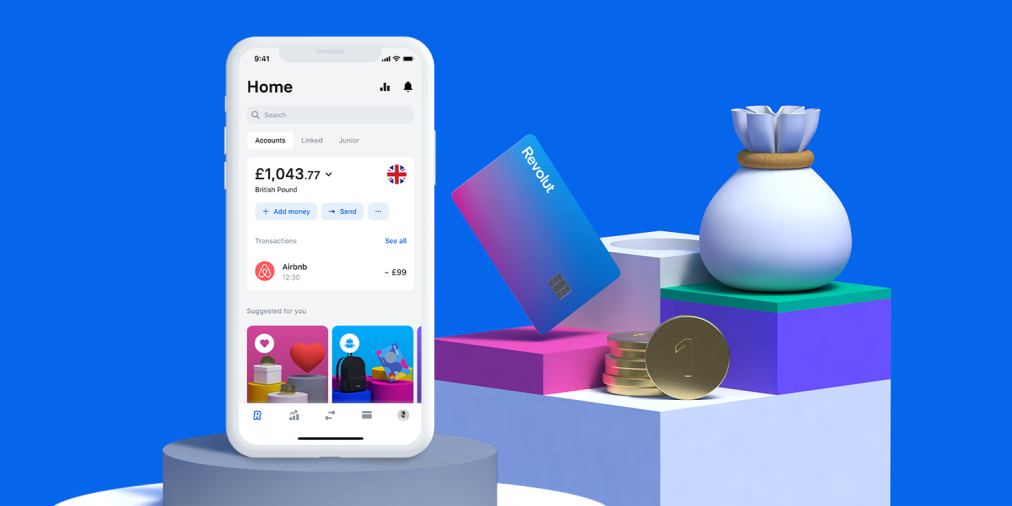

Now that the fintech pool is becoming oversaturated and customers have a lot to choose from, just like in dating… first impressions matter. As brands are vying for customer attention, it takes more than an amazing product with a sexy app to stand out and retain customer interest and wanting more.

Downloading an app and signing up is the first impression that will make or break the relationship. This initial interaction determines if the customer will continue using the app or ghost it during a complex and interrogatory onboarding process.

The sign-up process has to feel like a perfect first date where everything is easy, natural and effortless. The potential customer must not only feel special, entertained and engaged but also a sense of trust and transparency. If there are any red flags and the onboarding session feels forced and shady, the date can end abruptly.

For fintechs, unlike other industries, the onboarding process….. well…… it’s complicated. Financial companies are heavily regulated, meaning that they must incorporate many tedious personal questions and mandatory steps to ensure compliance.

Why Knowing your Customer is Important for Fintech Brands (KYC)

Know Your Customer (KYC) is a strict protocol that all financial companies must follow. It’s a process to verify the identity of their clients to eliminate fraud, identity theft, money laundering and to comply with their country’s legal requirements and regulations. It’s a way of making sure that a customer is who they say they are and weed out catfishing.

From the UX perspective, designing a compliant AND easy to use onboarding experience can make or break the relationship. When customers get frustrated by their sign-up experience, they are likely to abandon their online application. This not only costs fintech brands clients, but also ruins their reputation. It’s the first and the last date!

So how do you keep your date captivated, interested and wanting more in the not-so-sexy world KYC protocols? Well, some savvy fintechs brands have figured out how to do just that. They partner with an invisible 3rd party wingman that effortlessly and preemptively irons out the potential hic-ups of a first date.

Let’s look at an example:

Whether it’s a digital investment, money transfer or financial data management platform, a customer has to create an account and provide personal bank and/or credit card info. To authenticate and sign-up users seamlessly, some fintech brands are choosing to integrate Flinks’ financial data connectivity tool into their KYC onboarding process. With just a single step from the user–connecting their bank account during the sign-up process–the fintech can retrieve mandatory KYC information and complete the process in a snap. Easy peasy!

Essentially, these savvy fintechs brands are killing three birds with one stone. They are retaining control of their sexy front-end design, providing new customers with a fast and easy sign-up process and fulfilling KYC compliance guidelines. The sophisticated and mysteriously complex back-end process creates a WIN/WIN for the fintech and the customer. Perfect first date indeed!

Onboarding new customers–just like dating–is a combination of art, science and experience. It can be complicated, but only if you don’t understand what your client wants. But if a fintech brand gets it right, the reward is a long and beautiful relationship with happy, trusting and engaged users.

Want to know how Bridge Studio could help you with fintech branding? Contact us today

Written by Juliya Obukhovskaya

No comments.