What sets apart a good UX designer from a truly exceptional one? Beyond pixels and wireframes, great UX designers harness an uncanny power – the ability to connect with a business’ audience, aiding them in achieving their goals as effortlessly as possible.

Throughout my time managing UX designers, I've unearthed several key elements that truly elevate their value within the company:

They can possess the soul of the user

The hallmark of an exceptional UX designer lies in their unique capacity to detach from their own creation and view their interface through the eyes of the mere mortals using their interface. This transformative ability enables them to transcend biases, assumptions, and preconceptions, allowing them to view the interface with fresh eyes. As the designer who created the interface you know where to click and what to read but the user is seeing your design afresh.

To facilitate detachment from their own perspective, they employ the following four strategies:

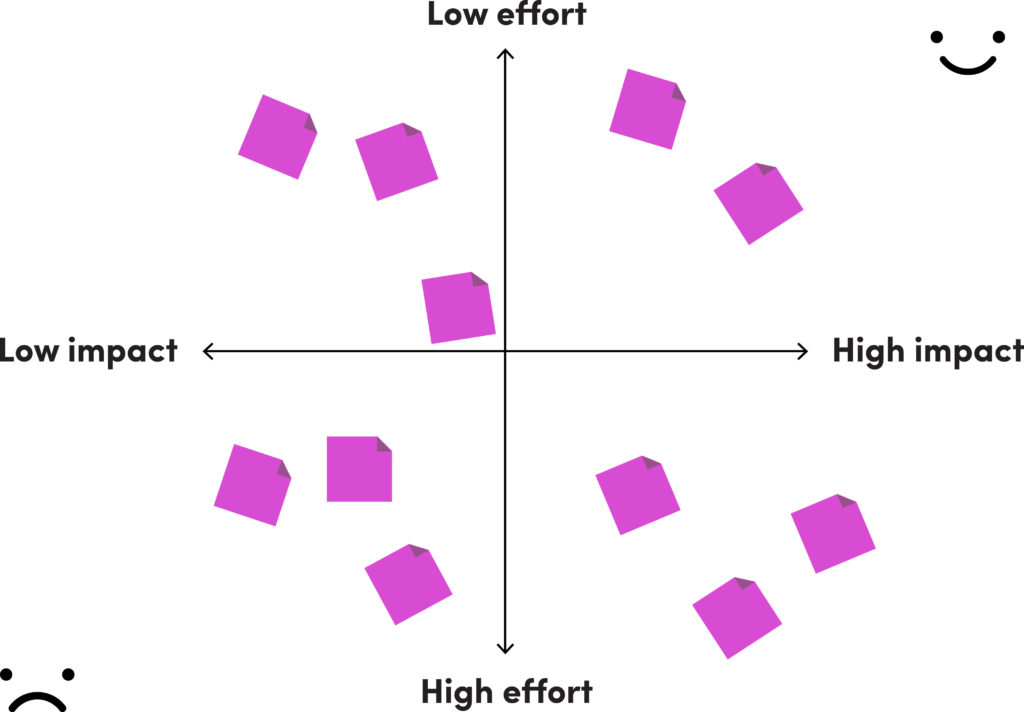

1 Analyse how the user's gaze traverses the page

Users exhibit varied scanning patterns. Many begin at the screen's top left corner, descending in an F-shaped trajectory. On other occasions, this pattern might mimic a Z. The dynamics could be intricate, particularly when a person's face graces the page, often becoming the initial focal point for users.

A proficient UX designer strategically positions essential UI elements where users' eyes naturally gravitate. Just last week, a student presented me with a design for an e-commerce website, positioning a product delivery/pickup selector beneath the page's headline. They soon realised that users overlooked it, mistaking it for a banner. Consequently, they relocated it adjacent to the primary call-to-action button, ensuring swift discoverability.

2 Navigate like the user

They meticulously navigate their work step by step, mirroring the user's journey. It's remarkable how fledgling designers might wrap up a user flow and declare, 'Voila, perfection achieved!' Yet, the crème de la crème of UX designers circle back to the flow's inception, probing: 'What's the user's initial click? What unfolds post-click? Does the headline aptly guide the desired user action?' This exercise of walking through flows as users do resembles a mini user-testing session, adept at unveiling a treasure trove of potential pitfalls.

3 Time

Users dedicate mere seconds to a website before rendering judgement on its utility. To seize their rapidly waning attention, conveying your website's value must transpire within a concise 10-second window.

4 Banner blindness

Users tend to skim over anything resembling a banner. Just recently, I overlooked the "Sign Up for Premier League Fantasy Football" prompt, mistaking it for an ad banner. My eyes frantically darted around, scouring typical spots like the top right corner for a good two minutes.

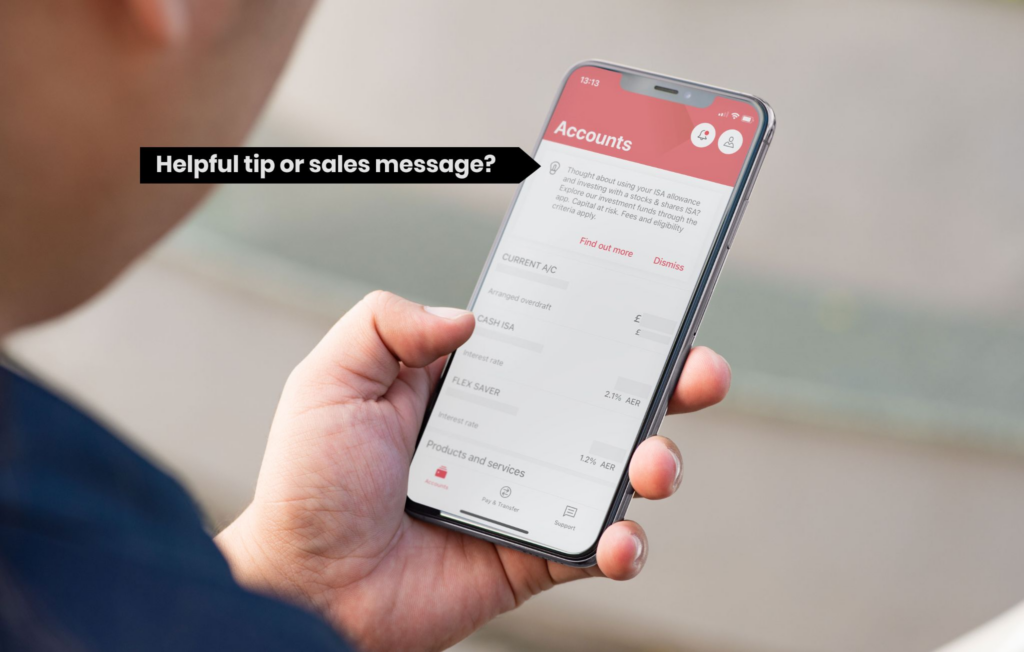

They question the almighty (client)

Challenging the client's perspective stands as a cornerstone of effective UX design. By questioning assumptions, designers unearth the subtleties of user behaviour, refine objectives, and harmonise design with genuine needs. Through adept probing, UX designers forge a path to more authentic, user-centric solutions, enhancing a product's usability and impact.

At times, it's all too simple to follow a client's directives without questioning their underlying rationale. When a request smacks of, 'I saw something cool on another site, let's have it too,' a skilled UX designer dares to probe. A valuable query to pose is, 'What's your goal with this request?' This inquiry peels back layers, unveiling whether the client's proposal aligns with their true intentions.

When a client insists on their design concept, a proficient UX designer complies while also offering an alternate proposal. This dual approach grants the client what they seek while infusing an added layer of insight. I’m often surprised by how often an initially odd-sounding client request actually hits the mark. A capable UX designer sets aside ego, delivering what the client desires, while also bestowing the gift of a second perspective.

Good UX designers try to break their own designs

The finest UX designers exhibit the curiosity of mischievous children who gleefully dismantle their own playthings to decipher their inner workings. Delving into your own design process and contemplating potential pitfalls highlights lurking issues. Consider scenarios like these: What occurs when a user enters an absurdly lengthy name into a form—yes, Salvador Domingo Felipe Jacinto Dalí i Domènech, I'm looking at you. Or when a user inputs an exceptionally short name, G Li, your time has come too. What unfolds when users attempt to send funds they lack? And what transpires when a user stretches the browser window, creating dimensions between mobile and tablet? Such inquisitive minds constantly ponder alternative ways to navigate potential interface snags.

Great UX designers will balance deep work with responding quickly to messages

There are few things worse than sending an urgent request to someone and receiving a metaphorical tumbleweed in response. Navigating the treacherous waters of UX design demands a delicate dance between immersive focus and swift communication. Like a maestro orchestrating a symphony, great UX designers waltz between bouts of deep work, sculpting pixels and pondering flows, and snappy message replies that could put a caffeine-charged squirrel to shame. After all, crafting seamless experiences requires both introspective design solos and nimble duets with clients, ensuring harmony prevails in every interaction. This is especially true in today’s world of remote work where you’re dependent on Slack messages and video calls for a cohesive team.

A lot of top-notch designers swear by 60-minute deep work sprints. During these focused sessions, they disconnect from messages to tackle tasks head-on. Once the sprint's over, they're all ears for urgent requests. But when the work isn't demanding laser focus, they're up for chats and friendly banter on Slack. It's all about striking that balance and being available when it counts.

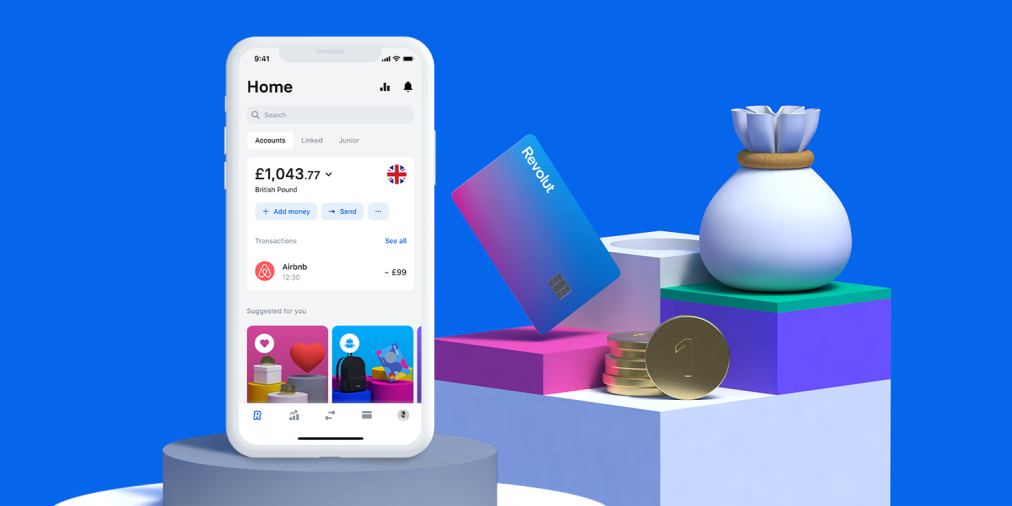

The best UX designers balance analytical and visual creative skills

They're the maestros who can whip up a drop-dead gorgeous interface that even the Dribbble crowd would turn green for, yet they never let aesthetics compromise functionality. I've witnessed a few UX designers in the past who hid behind their wireframes, hoping a UI designer would magically salvage their half-baked concepts. Personally, I'm not a fan of dividing designers into 'UX wireframe' and 'UI beautification' camps. It's like assigning blame to "Wireframe Johnny" for half the equation. A true star, however, doesn't just design; they prototype their creations. This isn't just about testing functionality – it's a backstage pass into how the grand design symphony should play out, making it a win-win for both design harmony and developer wizardry.

Communication skills are critical for the best UX designers

Nobody's signing up for the "Great Wall of Text" club, especially when three simple bullet points can save the day. This is especially true when managers are overburdened with emails and direct messages.

When it comes to user testing, nailing communication is non-negotiable. A sharp UX designer crafts tasks that guide users without giving away the answers, while also wielding the power of clever questions to extract those nuggets of gold. Asking the right questions is the secret sauce in user testing sessions.

And hey, let's not forget the unsung heroics of communicating with developers. A little knowledge of CSS, HTML and backend interactions goes a long way. Picture this: you're waiting on the backend to fetch a list of names, but it's taking longer than a sloth on a Sunday stroll. A savvy designer would spice things up with a skeleton loading state or a snazzy spinner. It's all about speaking their language to ensure everyone's in sync.

One of the most important parts of good communication is the ability to listen and stay open to what the user is telling you as well as showing you. Fully concentrating on what a client is saying is vitally important as it will help you create a more worthwhile product rather than just something pretty for your portfolio.

Conclusion: What makes a great UX designer?

In the dynamic world of UX design, the hallmark of exceptional designers lies in their ability to step into users' shoes, crafting interfaces that transcend personal biases. They strategically position UI elements, navigate through designs as users would, and embrace deep work alongside responsive communication. Balancing analytical acumen with creative finesse, they challenge client assumptions and foster authentic solutions while seamlessly connecting design intentions with user needs.

If you'd like to chat about how we might be able to help your business please feel free to get in touch!